Most clients I’ve worked with tend to use only one username in QuickBooks and they may or may not have a password set up, but there’s a very good reason why every user should have their own username that is password protected and not shared with anyone. If you need to segregate what changes were made and everyone uses the same username, there’s no way to know who made the change.

You should first set up a password for the Admin user and then restrict access to that password to the owner of the company or the person in the office who will supervise the use of QuickBooks. Admin can add users to the file and give each user privileges (or permissions) to access various areas of the data file.

These steps are very critical if you suspect someone is not trustworthy or you suspect fraud. This is difficult if a small business only has one person that is in charge of all tasks. There are audit reports to show exactly what was originally entered, when a change has been made including which user made the change on what date and time and what field was changed. If everyone uses one username, the audit report is not very useful and there’s no way you can prove who made the change.

Sometimes you need to look at your QuickBooks data in ways that aren’t on the standard reports in QuickBooks, but not often enough to require purchasing a third-party reporting tool. This can be accomplished by exporting detailed information to Excel and then using Pivot tables to put the information into useful tables of summarized information.

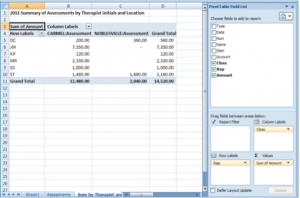

When you insert a pivot table, it asks you to define the range of data to use as a basis (including the headings)  and then displays a field list for you to select where to “drag & drop” the fields (as a filter, column label, row label, and sum value). The filter is used if you want to select a different value for the entire table (i.e., if I only wanted to look at one location).For example, one of my clients owns a private counseling center and one of their services is doing assessments. They wanted to know how many assessments were done by each of their staff over a period of time. In QuickBooks, they use the REP field on the invoice for the initials of the staff member. I created a custom Transaction Detail report in QuickBooks selecting the Invoice transaction type, Date, Client name, Class, Rep and Amount build the detail report for the pivot table. I then exported it to Excel. In Excel, I selected Insert > Pivot table and it will ask you to verify the range of the data you want to report from, then I selected my fields from the Pivot Table Field List by dragging & dropping them where I wanted to see the information and the display is immediate.

and then displays a field list for you to select where to “drag & drop” the fields (as a filter, column label, row label, and sum value). The filter is used if you want to select a different value for the entire table (i.e., if I only wanted to look at one location).For example, one of my clients owns a private counseling center and one of their services is doing assessments. They wanted to know how many assessments were done by each of their staff over a period of time. In QuickBooks, they use the REP field on the invoice for the initials of the staff member. I created a custom Transaction Detail report in QuickBooks selecting the Invoice transaction type, Date, Client name, Class, Rep and Amount build the detail report for the pivot table. I then exported it to Excel. In Excel, I selected Insert > Pivot table and it will ask you to verify the range of the data you want to report from, then I selected my fields from the Pivot Table Field List by dragging & dropping them where I wanted to see the information and the display is immediate.

The Class field for Assessments was placed in the column labels section (there are two locations that do assessments, so each goes into a separate column)

The Rep field was placed into the Row labels section

The Amount field was placed into the Sum Values section. Depending on the field you place in the Sum Values section, it may default to Count instead of Sum. To change it, just click on the arrow next to “Count of xxx” and select Value Field Settings and select a different calculation type (sum, average, max, min, etc.).

It’s that easy to wow your client with different ways to look at their data. And the best part is you can update the Excel spreadsheet with new QuickBooks data directly in Excel.

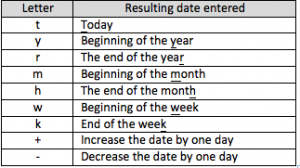

I like finding shortcut suggestions by other LinkedIn members because it helps us all learn more ways to help our clients save time in their jobs. I have been using QuickBooks for years and didn’t know about of the letter shortcuts, only +/- to add or subtract days.

I like finding shortcut suggestions by other LinkedIn members because it helps us all learn more ways to help our clients save time in their jobs. I have been using QuickBooks for years and didn’t know about of the letter shortcuts, only +/- to add or subtract days.

You can use a short one-letter abbreviation from the following table to enter a date if you frequently use specific days of the month to enter certain transactions or journal entries. For most of them, QuickBooks uses either the first or last letter of the words Today, Year, Month, and Week so they all are easy to remember.

These will become some of my favorite Tips and Tricks to pass along to help my clients save time. I hope they will be as useful to you.

Q. I have one employee who handles QuickBooks in our small business and I really need to replace them and get someone more competent in their place. The problem is I don’t know QuickBooks, so how can I get rid of them without causing a big headache for myself? I feel like I’m stuck.

A. I am amazed at how many horror stories I hear about situations like this. I try to educate all business owners how critical it is to document their business processes so that anyone can quickly step in and use this documentation and learn quickly what to do – it saves lots of money in the long run but very few companies do this.

In essence, you have an employee who thinks they’re hanging onto all the knowledge to ensure job security, but the employer feels like they are being held hostage. You need to get as much of that knowledge on paper before that employee walks out the door, or in case they leave suddenly due to illness or death and you suddenly lose the opportunity to gather information built up over so many years.

My advice would be to bring in a QuickBooks consultant to review and document current processes, both to ensure transaction accuracy and to create a document that can be used as a training tool for new employees. You will be able to sleep at night again knowing that you no longer feel like a hostage in your own business.

Every business needs to know if they’re selling their products or services for the right price to make a profit. Fortunately, QuickBooks has a tool to help you do that called Class Tracking.

Once you set the preferences to use class tracking, you set up user-defined classes and use them on all income and expense transactions. Then you run an Income Statement by Class to see each class’s profitability. Once you commit to using classes, you must commit to always entering them for this feature to be effective. There is also a report at month end to show unclassified accounts to identify transactions that are missing a class designation so it can be corrected.

I have a client who uses class tracking extensively for his private counseling center to determine whether his therapy groups are making or losing money based on his overhead and other expenses.